How to Calculate a Company’s Weighted Average Number of Outstanding Shares The Motley Fool

If you find that annoying, select “Unstick” to keep the panel in a stationary position. Select Show or Hide to show or hide the popup keypad icons located next to numeric entry fields. These are generally only needed for mobile devices that don’t have decimal points in their numeric keypads. So if you are on a desktop, you may find the calculator to be more user-friendly and less cluttered without them. Also note that some calculators will reformat to accommodate the screen size as you make the calculator wider or narrower. If the calculator is narrow, columns of entry rows will be converted to a vertical entry form, whereas a wider calculator will display columns of entry rows, and the entry fields will be smaller in size …

How are weighted average shares outstanding different than basic shares outstanding?

This metric is crucial for calculating earnings per share (EPS), as it provides a more accurate representation of a company’s equity situation over time. It considers the timing of when shares were issued or repurchased, ensuring that only the shares that were actually available for trading during the reporting period are counted. Outstanding shares represent a company’s shares that are held by investors, whether they’re individual, institutional, or insiders. Investors can find the total number of outstanding shares a company has on its balance sheet. Outstanding shares can also be used to calculate some key retained earnings financial metrics, including a company’s market cap and its earnings per share. They are separate from treasury shares, which are held by the company itself.

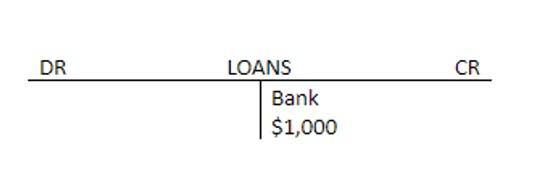

Impact of stock dividend and stock split on weighted average number of shares outstanding

- Notice that Alpha Inc. has ignored 25,000 shares issued on December 31 in above computation.

- Basic weighted average shares, on the other hand, represents the above-mentioned weighted average shares outstanding less the dilution of stock options for a specific period.

- Treasury stock consists of shares that the company has acquired in a buyback.

- To calculate a weighted average of the price paid for the shares, the investor must multiply the number of shares acquired at each price by that price, add those values, and then divide the total value by the total number of shares.

- Using the SUMPRODUCT function, we’ll calculate the weighted average shares outstanding over fiscal year 2021, which comes out to 448,265.

- They are separate from treasury shares, which are held by the company itself.

- Let’s say that a company earned $100,000 this year and wants to calculate its earnings per share (EPS).

Companies with large cash reserves on their balance sheets may also be able to repurchase stock more aggressively, thus decreasing the number of shares outstanding and increasing its earnings per share by using its existing cash. For example, let’s say a company has 100,000 shares outstanding at the start of the year. Halfway through the year, it issues new shares in the amount of an additional 100,000 shares. Weighted average shares outstanding is the process of weighting every number of common stock to reflect how much time they were in effect. When the shares outstanding formula number of outstanding shares is changed by a stock dividend or split, the firm’s earning power is not affected.

- Divide the total by 12, the number of months in a year, to find the weighted average common shares outstanding.

- These include changes that take place because of stock splits and reverse stock splits.

- A company’s outstanding shares decrease when there is a reverse stock split.

- While outstanding shares are a determinant of a stock’s liquidity, the latter is largely dependent on its share float.

- To calculate the weighted average of outstanding shares, multiply the number of outstanding shares per period by the proportion of the total time covered by each period.

- A stock dividend only affects those shares that already exist prior to its occurrence.

- This number is significantly important for public companies as it constitutes the basis for computing important financial metrics like earnings per share (EPS).

How Outstanding Shares Work

Moving the slider to the left will bring the instructions and tools panel back into view. Clicking the “Reset” button will restore the calculator to its default settings. Follow me on any of the social media sites below and be among the first to get a sneak peek at the newest and coolest calculators that are being added or updated each month.

- Common examples would be calculating the company’s earnings per share or per-day outstanding share.

- The weighted average is a significant number because companies use it to calculate key financial measures with greater accuracy, such as earnings per share (EPS) for the time period.

- This is the calculated number of days from the beginning date to the ending date.

- These include a company’s market capitalization, such as market capitalization, earnings per share (EPS), and cash flow per share (CFPS).

- The numerator in the earning per share (EPS) formula is net income from the income statement, which tracks the financial performance of a company over a period of time.

Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Based in the Kansas City area, Mike specializes https://www.facebook.com/BooksTimeInc in personal finance and business topics. He has been writing since 2009 and has been published by “Quicken,” “TurboTax,” and “The Motley Fool.”